Seeing Beyond the Negative: Rethinking Risk in Decision-Making

Life is a journey filled with choices, and many of these choices involve risks.

Some risks can lead to great rewards, while others might bring us close to ruin. Whether it's deciding to work for a startup versus a big corporation, investing in bonds versus stocks, or choosing a life partner, risk is a common factor in all these decisions.

But what exactly is risk?

Often, we use this word without fully grasping its meaning, and it's often associated with negativity. However, this negative connotation isn't entirely accurate.

Let's explore risk through a simple analogy. Imagine you have a big box of colorful candies. Some candies are delicious, while others might not be so tasty. Risk is like trying to predict which candies are yummy and which ones aren't before you pick one. Sometimes, you'll choose a delicious candy, and that's wonderful! Other times, you might pick a not-so-yummy one, and that's perfectly fine too.

When we discuss risk, we're essentially talking about the likelihood of something good or not-so-good happening when we make choices, just like picking candies. It involves thinking about the probability of different outcomes, both positive and negative.

Now, why do we tend to associate risk with something bad?

It's because humans have a natural tendency to be more concerned about losing what they already have than gaining something new. This innate fear of loss has evolved over time to help us survive. For instance, we worry more about losing food or safety than gaining extra possessions.

This idea aligns with Nobel Prize winner Daniel Kahneman's Prospect Theory, which suggests that we give more weight to potential losses than gains when making decisions. Often, we neglect to consider the possible upsides of our choices.

Thinking about the upside is indeed challenging. It's easier to imagine undesirable outcomes and assign probabilities to them. Our default mindset doesn't easily quantify the intangible benefits of a decision. For instance, if we decide to start a new business, we may think about the tangible aspects like money, time commitment, and job security, while neglecting the intangible benefits like personal growth, leadership skills, and networking opportunities.

When we evaluate risk, our focus is often on how to limit or control it, rather than how to enhance the potential for reward. Instead of solely managing risk, we should also learn how to take calculated risks. This shift from managing to taking risks is not the same as gambling; it involves considering both potential upsides and downsides while ensuring that catastrophic outcomes are avoided.

So, the question arises: How can we make thoughtful decisions with a risk-reward approach?

Risk-Reward Trance

Indeed, finding a balance between safeguarding against potential disaster and seizing opportunities for growth is crucial. To thrive in life, it's essential to first ensure your survival. The key lies in making well-informed decisions that carefully consider not only immediate gains or losses but also the intangible benefits that can lead to personal and professional development.

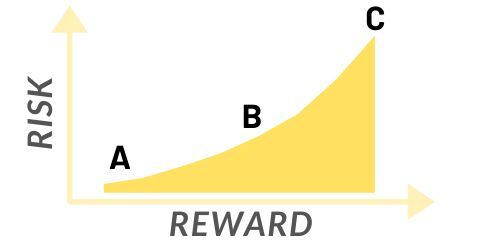

"All things equal — someone willing to take more risk will expect a higher potential reward for taking that risk. So as risk increases, so should potential return"

As you assess risk, it's vital to place special emphasis on uncovering the true probabilities associated with the upside, which is the potential reward. In general, when someone is willing to take on more risk, they should reasonably expect a higher potential reward for taking that risk. This relationship between risk and reward is relatively straightforward: the more risk you're willing to embrace, the greater the potential reward should be.

Here’s how Chamath Palihapatiya, ex-Facebook exec and venture capitalist, ended up joining Facebook in early 2007:

Years later while working at AOL, Palihapitiya did a deal to integrate Instant Messenger with a fledgling product called Facebook (He had wanted AOL to try to buy Facebook, but the company was too tangled up in legal drama).

Eventually the partnership unraveled, and Facebook’s founder (a then-teenage Mark Zuckerberg) asked Palihapitiya if he would leave the venture firm where he had taken a job, and join the startup instead.

“I said, ‘What is the distribution of outcomes at Facebook?’ he asked himself at the time.

“Most of the scenarios were less than [I would make at the venture firm], but there were a few scenarios where I could make a case that it could be equivalent to what I would make at Mayfield over a four-year period, and in a very small number of cases it would be in excess,” Palihapitiya said. Even if it doesn’t work out, he thought, “I will have met some of the smartest people in the world, and I’ll be in the game. And I will have learned something about myself, whether I can do something at a really early-stage scale.”

As it turned out, of course, Facebook was a pretty good bet for him.

Source: Fortt Knox Podcast (CNBC)

Jeff Bezos has a similar framework called the "The Regret Minimization Framework” which is premised on a single question: In X years, will I regret not doing this?

Here’s Jeff Bezos in his own words:

I knew that when I was 80 I was not going to regret having tried this. I was not going to regret trying to participate in this thing called the Internet that I thought was going to be a really big deal. I knew that if I failed I wouldn’t regret that, but I knew the one thing I might regret is not ever having tried.

In other words, this prompts us to consider the significant potential benefits of a decision. When we believe that the potential upside of an idea or choice is substantial, but we opt not to pursue it due to concerns about higher risk, there's a strong likelihood that we'll eventually regret that decision. Our ultimate objective should be to minimize regrets in the future by carefully weighing the potential rewards against the risks before making choices.

Conclusion

In conclusion, understanding risk is about embracing the uncertainties of life's choices while recognizing that risk is not solely a harbinger of negative outcomes. It's a vital ingredient in the recipe of success and personal growth. By focusing on the potential upside, assessing probabilities, and adopting a balanced approach that acknowledges both tangible and intangible benefits, we can make more thoughtful decisions.

As you navigate your own path, remember the wisdom of those like Chamath Palihapitiya and Jeff Bezos: the regret of not trying can often outweigh the fear of failure. So, dare to take calculated risks, aim high, and strive for those astronomical returns, all while managing the downsides adeptly. In the end, it's the journey of risk-taking that often leads to the most rewarding destinations in life.

Till next time.

Raheel